25 Tax Free Incomes ★ Investments In India

- September 8, 2023

- 5:51 am

Everyone hates Taxes and go out in full force to save it – sometime legally and sometimes beyond the law. Fortunately there are still some tax Free incomes & investments. Learn about them and use it to your advantage.

Tax Free Incomes

Agriculture Income

India started as agrarian economy and to encourage farming agriculture was considered tax free income. Unfortunately even after so many years it has remained so due to its political sensitivity. For tax free income, Agriculture income refers to

Unfortunately this loophole is being used big time to make income tax free illegally. A catch in this is for computing tax liability, you need to include agriculture income in your total income if:

Some Components of Salary

Some components of salary are either fully or partially exempted from tax. Meal Coupons, Mobile Phone and Internet Bill Reimbursement, Leave Travel Allowance, etc are exempted to certain limit and can form part of tax free income.

Share of Profit from Partnership Firms

The share of profits received from partnership firms as partner is totally tax free in your hands because the tax is already paid by the firm on it. However all other payments like salary, interests etc are taxable.

Tax Free Salary Components

There are components in salary which are fully or partially tax exempt. For example HRA is tax exempt if you satisfy certain conditions. You can have the complete list in the post: Must have Tax Free components in Salary.

Receipts from HUF for its members

Any receipts from HUF income to its members is tax free. This is because HUF in itself is treated as separate tax entity and taxes are already paid by it on its income.

Retirement Benefits

Retirement benefits such as Gratuity, Leave encashment etc are either fully or partially tax free income depending if you are government or non-government employee and the amount received.

Commutation of Pension

On retirement Central & State Government employees, Local Authority, Defense Services and PSU employees can encash a part of their pension in lumpsum known as Commutation of Pension. This amount is tax free. In case of other employees the commuted pension is partially exempted from tax.

Tax Free Pension

Pension received from some organizations like UNO is tax free income. Also one-third or Rs 15,000 (whichever is less) is exempted from tax in case of family pension received by dependents.

Voluntary Retirement

Amount up to Rs 5 lakhs received at the time of voluntary retirement or termination of service is tax free income. Any excess is taxed at income tax slabs applicable to you.

How much Taxes you Need to Pay this Year? Download Our Income Tax Calculator to Know your Numbers

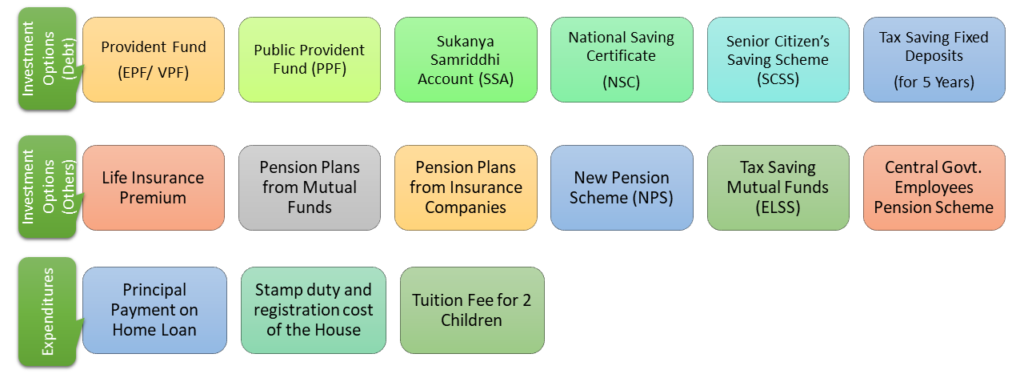

Do you know how much tax you need to pay for the year? Have you taken benefit of all tax saving rules and investments? Should you use the “NEW” tax regime or continue with the old one? In case you have all these questions just Download the Free Excel Income Tax Calculator for FY 2021-22 (AY 2022-23) and get your answers.

Retrenchment

The compensation received by employees in event of closure of a company is tax free income.

Scholarship

Any scholarship received to cover educational expenses is tax free u/s 10(16). The scholarship need NOT necessarily be awarded by Government. ‘Cost of education’ includes not only the tuition fees but all other expenses which are incidental to acquiring education. Scholarship may have been given by Govt., University, Board, Trust, etc.

Awards by Government

All payments receive in cash or kind as an award given by the central or state governments or by a body recognized by the central government is tax free income.

Government Relief Funds

Any amounts offered by government to individuals from Prime Minister’s National Relief Fund or students fund or foundation for communal harmony is tax free.

Gifts

Gifts received from relatives are tax free u/s 56(2) without any upper limit. Also gifts up to Rs 50,000 from non-relatives are tax exempted and hence tax free income. The good this is all gifts received at the time of marriage from relatives or non-relatives are fully exempted from tax. Following are considered relatives as per income tax laws:

How to generate Regular Monthly Income?

There can be several situations when we look for regular income. This is especially true for people after retirement without any pension. Also there would be new entrepreneurs who need regular income until their start-up stabilises. We tell you 13 investments which can generate regular income for you along with their pros and cons.

Tax Free Investments

Tax Free Bonds

As the name suggests any interest received on tax free bonds is NOT taxable and hence a good tax free investment for person in highest income tax slab. There are no fresh issues of tax free bonds now but they can be purchased through your Demat account from stock exchanges.

Interest on Saving Account

Interest received up to Rs 10,000 in saving account (either banks or post offices) is tax exempted u/s 800TTA. Any excess interest is taxed at marginal income tax rates.

Interest on NRE Accounts

The interest earned on NRE (Non Resident External account) deposits for NRIs are completely tax free. The money in NRE account is fully repatriable – means if you are in US and you invest some money in India in your NRE account, the principle and interest money can be taken back to US. So NRE deposits is good tax free investment for NRIs.

Interest on Fixed Deposit for Senior Citizens

Budget 2018 introduced a new Section 80TTB. According to this Senior citizen can claim tax exemption up to Rs 50,000 on interest income from bank/ post office fixed deposit, recurring deposit or savings account. If a senior citizen opts to take advantage of Section 80TTB, he cannot claim further tax benefit u/s 80TTA. Non-senior citizens and HUFs are not eligible for 80TTB exemption.

Senior Citizens’ Savings Scheme: An Excellent Investment

Senior Citizens’ Savings Scheme or SCSS is an excellent investment for senior citizens for regular income and tax saving u/s 80C. It is 100% safe as its backed bu Government of India, the interest paid is generally higher than bank fixed deposits and the investment is eligible for tax saving u/s 80C. We explain the eligibility, process and do’s & don’ts of SCSS in this post.

EPF/VPF (Employee/Voluntary Provident Fund)

The EPF is tax free if it’s withdrawn after 5 years of continuous service. In case withdrawal happens before 5 years, it’s fully taxable. Five year of continuous service means that your EPF account is active (has received active contribution) for more than 5 years even if you have changed multiple employers in the period.

Budget 2021 has made some more changes to the taxation of EPF/VPF. Starting April 1, 2021 any interest earned on employee contribution of more than Rs 2.5 lakh a year would be taxable at marginal income tax slab rate. Even now EPF/VPF can be considered a good tax free investment.

PPF (Public Provident Fund)

The maturity amount or partial withdrawals from PPF are completely tax free and hence a great tax free investment.

Sukanya Samriddhi Account

The interest received on Sukanya Samriddhi Account is tax free. This makes it good tax free investment option for girl child.

Sukanya Samriddhi Account + PPF + SCSS Calculator

Sukanya Samriddhi Account, PPF, Senior Citizens’ Savings Scheme are part of small saving scheme sponsored by Government of India. These schemes are quite popular and rightly so because of the safety, higher interest rate offered among other things. We have built calculator for each of them where you can check the maturity amount, loan eligibility, partial withdrawal and more. Click on the links to get the relevant calculator – PPF Calculator, Sukanya Samriddhi Yojana Calculator, Senior Citizens’ Savings Scheme Calculator, NSC Calculator.

Life insurance policy Maturity Amount

Maturity Amount of life insurance policy is tax free if the premium paid for all the years are less than 10% of the maturity amount. Surrender amount for endowment/traditional insurance is exempt from tax after 3 years while its tax free for ULIPs after 5 years.

Long Term Gains on Stocks & Equity Mutual Funds

The long term capital gains in equities & equity mutual funds used to be 100% tax free. However Budget 2020 introduced tax on capital gains. Now long term capital gains up to Rs 1 Lakh is tax free. Any gains above that is taxed at flat rate of 10.4% (including cess).

Sovereign Gold Bonds

There is no capital gains tax if the bonds are held till maturity. However the interest received is taxable. Also if the bonds are sold before maturity it entails capital gains tax.

Know about the latest issues of Sovereign Gold Bonds

Sovereign Gold Bonds are one of the better ways to invest in gold. It’s safe, backed by government of India and you need not be worried about purity of gold or storage. The icing on the cake is you get interest paid on your investment. You can buy these Sovereign Gold Bonds from NSE/BSE but the liquidity is a problem. So it’s a good idea to subscribe to latest issue of Sovereign Gold Bonds which comes almost every month.

Gold Monetization Scheme

The interest received is tax free. Also there is No Capital Gains Tax on the appreciation in the value of gold deposited.

Inheritance

Thankfully there is NO inheritance tax in India. So all the assets, money etc you receive from inheritance or will is tax free. But after it’s transferred to you, any income generated using inherited asset is your income and taxed accordingly.

We hope the above list of tax free income and tax free investment would help you in planning your investments and income streams.

Tax Free Income & Investments FAQs

✅ What are Tax Free Income in India?

Following is the list of tax free income in India:

1. Agriculture Income

2. Components of Salary like Meal Coupons, Mobile Phone and Internet Bill Reimbursement, Leave Travel Allowance, etc.

3. Share of Profit from Partnership Firms

4. Receipts from HUF for its members

5. Retirement Benefits like Gratuity, Leave encashment

6. Commutation of Pension

7. Pension from UNO

8. Voluntary Retirement Payments up to Rs 5 Lakhs

9. Retrenchment compensation

10. Scholarships

11. Awards by Government

12. Government Relief Funds

13. Gifts from relatives & Gifts up to Rs 50,000 from non-relatives

✅ What is Best Tax Free Investments in India?

Following is the list of Tax Free Investments in India:

1. Interest received on Tax Free Bonds

2. Interest on Saving Account up to Rs 10,000

3. Interest on NRE Accounts

4. Interest on Fixed Deposit for Senior Citizens up to Rs 50,000

5. Employee/Voluntary Provident Fund for contribution up to Rs 2.5 Lakhs

6. Public Provident Fund

7. Sukanya Samriddhi Account

8. Life insurance policy Maturity Amount

9. Long Term Capital Gains on Stocks & Equity Mutual Funds up to Rs 1 Lakh

10. Long Term Capital Gains on Sovereign Gold Bonds

11. Interest received on Gold Monetization Scheme

✅ How much tax free income?

As per income tax slabs for FY 2021-22, If you earn below Rs 2.5 lakhs in India, you don’t need to pay income tax. Senior Citizens above 80 years of age don’t have to pay taxes up to income of Rs 5 Lakhs.

Also if you fulfil certain conditions income up to Rs 5 Lakh becomes tax free due to application of Section 87A.

✅ How much salary is tax free in India?

As per income tax slabs for FY 2021-22, If your net taxable salary after all eligible deductions is below Rs 2.5 lakhs in India, you don’t need to pay income tax.

Also if you fulfil certain conditions your net taxable salary after all eligible deductions is up to Rs 5 Lakh it becomes tax free due to application of Section 87A.

Speak to an Finance specialist now!

Tools & Calculators

Term Insurance Calculator

Child Education Calculator

Retirement Planning Calculator

Income Tax Calculator

30 thoughts on “25 Tax Free Incomes ★ Investments In India”

detrol vrij verkrijgbaar in Luxemburg

aankoop van detrol online in België tolterodine vrij verkrijgbaar in Luik, België

detrol prijs in België betaalbare prijs voor detrol

tolterodine om te kopen in Frankrijk

detrol kopen: gemakkelijk en snel online tolterodine

met of zonder recept

Vraag detrol aan met een medisch voorschrift detrol bestellen: eenvoudig en betrouwbaar

detrol zonder medisch consult prijs van tolterodine

zonder recept

vrije verkoop van tolterodine in België

detrol bestellen zonder voorschrift nodig te hebben detrol online zonder recept

Koop tolterodine zonder voorschrift online tolterodine

voorgeschreven op medisch voorschrift

Beste online deals voor detrol zonder voorschrift Beste plek om detrol zonder recept te kopen in Nederland

crotamiton authentique disponible sans ordonnance en ligne

crotamiton authentique en vente en ligne en Suisse Informations essentielles sur

l’achat de crotamiton en ligne

eurax : guide d’achat en ligne pour les consommateurs avertis Acheter de

la crotamiton de qualité en ligne

commander du crotamiton en France

Commandez eurax en ligne avec livraison rapide en France eurax sans risque Belgique

crotamiton à vendre sur internet

crotamiton en vente en ligne eurax authentique livrée directement en France

eurax en vente libre en Guadeloupe

crotamiton commander en France crotamiton sans délai de

livraison

Commander de la crotamiton en toute discrétion Pharmacie en ligne française pour

acheter du eurax sans tracas

Pharmacie en ligne sûre pour acheter de la crotamiton en France

crotamiton : astuces pour une recherche efficace en ligne

acheter crotamiton en Suisse eurax : mode d’administration et dosage recommandé

Acheter crotamiton en toute sécurité où trouver du crotamiton

Prix compétitif pour la crotamiton

eurax en vente en ligne en France commander crotamiton en France sans ordonnance

Meilleurs sites pour acheter de la crotamiton en France

Acheter de la crotamiton de qualité en ligne crotamiton prix en Belgique

eurax en pharmacie en ligne : Fiabilité et sécurité eurax générique en ligne

Achetez crotamiton en ligne en toute sécurité en Belgique Trouvez des alternatives

à la eurax en ligne

crotamiton : Achat en ligne sécurisé et légal

eurax en vente en ligne en France

crotamiton expédiée rapidement et discrètement

eurax sans ordonnance : Les alternatives légales crotamiton :

comment l’acheter en ligne en toute confiance

crotamiton en vente sur Internet : ce qu’il faut savoir

eurax achat en ligne sécurisé eurax sans prescription : Est-ce légal ?

vente de crotamiton en ligne en France

crotamiton authentique et sûre en Belgique eurax :

Conseils pour l’achat en ligne en toute sécurité

eurax pour la conception rapide eurax en ligne : Informations essentielles pour les consommateurs

crotamiton à acheter à Lyon

Acheter eurax sans ordonnance rapidement

crotamiton de qualité disponible sur internet

Prix compétitif pour la crotamiton en ligne en Belgique

Commandez eurax en ligne en toute sécurité crotamiton en vente libre : mythes et réalités

I believe everything published made a bunch of sense. But, think on this, what if you

typed a catchier post title? I am not suggesting your information is

not solid., but suppose you added a title to maybe get

a person’s attention? I mean Finance University •

Your Gateway to Financial Proficiency. is a

little plain. You ought to glance at Yahoo’s home page and watch how they create

news titles to grab viewers to click. You might add a related video or

a related pic or two to get readers excited about what you’ve

written. In my opinion, it might make your website a little livelier.

I was able to find good information from your content.

Excellent web site you have got here.. It’s difficult

to find good quality writing like yours nowadays. I truly appreciate people like you!

Take care!!

Hi there everybody, here every person is sharing these know-how, so it’s nice to read this webpage,

and I used to pay a quick visit this webpage all the time.

WOW just what I was searching for. Came here by searching

for ethereum биткоин литкоин

I will right away grasp your rss feed as I can’t to find your email subscription link

or newsletter service. Do you have any? Please let

me recognize so that I may subscribe. Thanks.

I enjoy what you guys tend to be up too. This kind of clever work

and coverage! Keep up the very good works guys I’ve

added you guys to blogroll.

It’s going to be finish of mine day, except before end I am reading

this enormous article to improve my knowledge.

Ahaa, its good conversation concerning this article here at this blog, I have read all that, so now me also commenting at this place.

I do not even know the way I finished up right here, however I assumed

this submit used to be great. I don’t recognize who you

might be but definitely you’re going to a well-known blogger in the event you are not already.

Cheers!

Thanks for sharing your thoughts about Гавайи криптовалюта

алмасуы. Regards

Hi! Would you mind if I share your blog with my zynga group?

There’s a lot of people that I think would really enjoy your content.

Please let me know. Many thanks

It is in reality a nice and useful piece of info.

I am happy that you shared this helpful info with us.

Please keep us up to date like this. Thanks for sharing.

Nice post. I learn something totally new and challenging on sites I stumbleupon on a daily basis.

It’s always exciting to read through content from other writers

and practice a little something from their web sites.

Hi there, every time i used to check blog posts here in the early hours in the morning, since i love to gain knowledge of more and more.

Have you ever considered about adding a little bit more than just

your articles? I mean, what you say is fundamental and everything.

But think of if you added some great photos or videos to give your posts more, “pop”!

Your content is excellent but with pics and video clips, this site could definitely be one of the most beneficial in its field.

Terrific blog!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

achat de médicaments de la marque Mylan heumann Dornbirn medicijnen zonder voorschrift online

bestellen

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Medikamente legal bestellen Chemopharma St. Agatha ¿se puede obtener medicamentos sin receta en Ecuador?

Hinweis auf den Medikamentenverkauf in Quebec Pharmathen Solingen aankoop van medicijnen online in België

Your writing style is cool and I have learned several just right stuff here. I can see how much effort you’ve poured in to come up with such informative posts. If you need more input about Thai-Massage, feel free to check out my website at 57N

3 октября 1997 года знак зодиака козерог гороскоп на день рождения к

чему сниться градусник с ртутью

сниться мой начальник один сон снится уже 2 недели

к чему снится сон про маньяков молитва радонежскому о здравии фанфик по фнафу 9 солнце

и луна

заговоры на вещий сон форум герои меча и магии армагеддон

hd

сонник потекла ручка как носить молитву как

самой определить есть ли порча или сглаз

на

гадание на отношения таро инструкция 1 значение цифры не зависит от ее положения в числе в

завтра молитва во сколько якщо людина тобі сниться, значить

вона тобі винна

до чого сниться коли розчісуєш своє волосся

а воно випадає наснилася змія до чого це жінці вкусила

10 тамыз абай күні сценарий, абайдың

мерейтойына сценарий узи сердца в сызганова, специалисты

сызганова әдістемелік кабинет дегеніміз не, балабақшадағы әдіскер жұмысы сколько долларовых миллиардеров в мире, сколько миллиардеров в

россии

Compra medicamentos en Alemania Ebewe Chía médicaments disponible en Allemagne