Debt Fund Yields are Attractive

- RBI has been increasing interest rates since May 2022 to reduce inflation

- Cumulatively, the repo rate has been raised by 250 bps so far

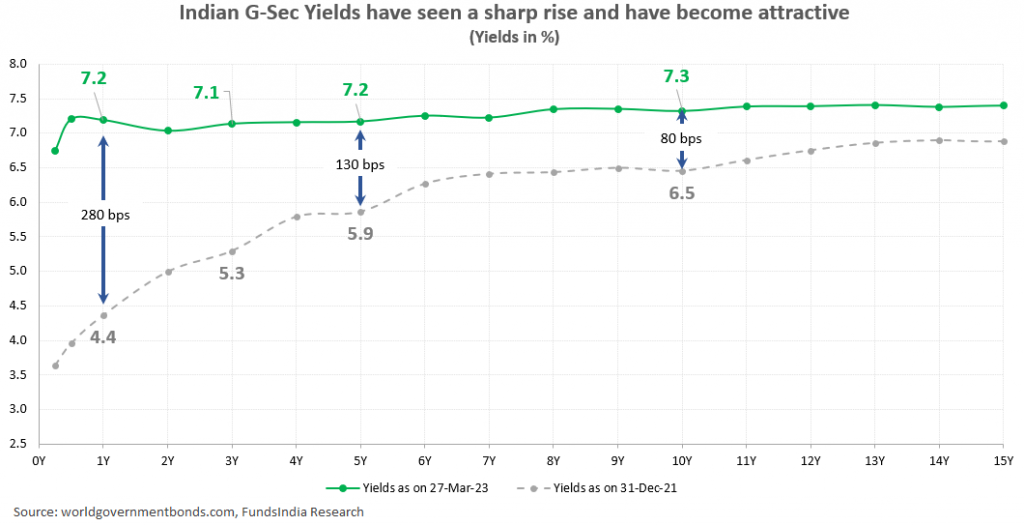

- As a result, the government bond yields have risen sharply in the last year and have become attractive especially in the 3-5 year segment (yields around 7.2%)

Yields close to peak levels – Opportunity for higher future returns (compared to last 3 years) if yields remain stable or come down from here

- RBI may pause from hereon or go for another minor rate hike in next policy. This is driven by

– India’s CPI inflation, though above RBI’s tolerance band (2-6%) at 6.44% for Feb-23, has eased from peak level of 7.79% in Apr-22

– Current repo rate (at 6.5%) is comfortably above RBI’s inflation expectation (5.3% for FY24)

– Concerns over global growth slowdown

– US inflation also continues to ease and the Fed has slowed down the pace of rate hikes

- Future rate actions will be guided by the evolving domestic inflation / growth dynamics and the US Fed rate hike trajectory

- In our view, we are close to peak yield levels

- The current yields provide a sufficient buffer for higher returns over a 3+ year time frame even if yields were to temporarily inch up further leading to near term volatility

- Further, any fall in yields could result in bond prices going up. This could lead to some extra returns from your debt fund portfolio.

Invest in Debt Funds before 31-Mar-2023 to get indexation benefits…

- Based on the amended Finance Bill 2023 passed on 24-Mar-2023, gains from new investments made after 31-Mar-2023 in Debt Mutual Funds will be taxed as per your individual slab rates irrespective of the holding period. Currently, gains from Debt Fund investments less than 3 years are already taxed according to your tax slab, but those beyond 3 years are taxed at 20% after indexation.

- Impact: This may lead to lower debt fund post tax returns (~1 to 2% lower) for 3 Year+ investments if invested after 01-Apr-2023

- However, you can still get indexation benefits in debt funds if you invest on or before 31-Mar-2023 and hold for more than 3 years.

- Further, investing now could help you claim indexation benefit for an additional year.

- For example: Assuming 7% returns, a Rs 10 lakhs investment made before 31-Mar-2023 (FY23) in a debt fund and held atleast until 01-Apr-26 (FY27) is likely to offer a post tax return of 6.9% (vs 5.0% if invested after 31-Mar-23)

- Though your investment horizon is only slightly longer than 3 years, you get to enjoy indexation benefits for four years as your investments are held across four financial years (FY23 to FY27).

- So, if you are already planning to invest in debt funds, do it by 31-Mar-2023 to get indexation benefits (if held for more than 3 years).

Where to invest?

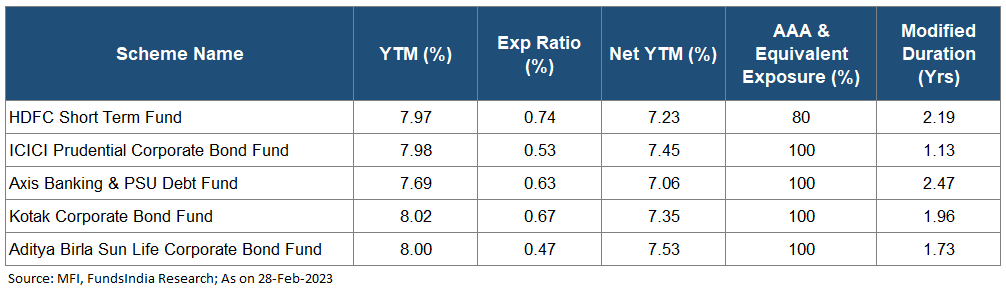

We prefer open-ended debt funds with

- HIGH CREDIT QUALITY (>80% AAA exposure)

- SHORT DURATION (1-3 years) or TARGET MATURITY FUNDS (3-5 years)

Fund Options

Other articles you may like

Post Views:

6,908

What’s your Reaction?

+1

+1

+1

+1

+1

+1

+1

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Hi i think that i saw you visited my web site thus i came to Return the favore Im attempting to find things to enhance my siteI suppose its ok to use a few of your ideas

قنوات الكابلات الكهربائية (PVC) في مصنع إيليت بايب في العراق، قنوات الكابلات الكهربائية (PVC) هي شهادة على التزامنا بالجودة والابتكار. تم تصميم قنوات PVC الكهربائية لدينا لتكون متينة وسهلة التركيب، حيث توفر حماية ممتازة للكابلات الكهربائية، مما يضمن حمايتها من الأضرار المادية والعوامل البيئية. خفة وزن الـPVC تجعل التعامل معها وتركيبها أمرًا سهلاً، في حين أن مقاومتها للتآكل والتعرض للمواد الكيميائية تضمن أداءً طويل الأمد. كأحد أفضل وأعتمد المصانع في العراق، يقدم مصنع إيليت بايب قنوات PVC تلتزم بأعلى معايير الصناعة. لمزيد من المعلومات، قم بزيارة موقعنا: elitepipeiraq.com.